does michigan have a inheritance tax

An inheritance tax is a levy assessed upon a beneficiary receiving estate property from a decedent. As you can imagine this means that the vast majority of estates are not subject to a.

How To Avoid Estate Taxes With A Trust

Does Louisiana Have an Inheritance Tax.

. Technically speaking Michigan still retains an inheritance tax and an estate tax in its statutes but neither tax would apply to anyone who died today. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains in effect. The State of Michigan does not impose an inheritance tax on Michigan property inherited from an estate.

Michigan does not have its own Estate Tax however your estate may be. Give any less than that and there is no federal gift tax whatsoever. A copy of all inheritance tax orders on file with the Probate Court.

Mortgage Calculator Rent vs Buy. Moreover the tax is paid by the beneficiary after the assets have been transferred out of the estate. An inheritance tax on the other hand is a tax imposed only on the value of assets inherited from an estate by a beneficiary.

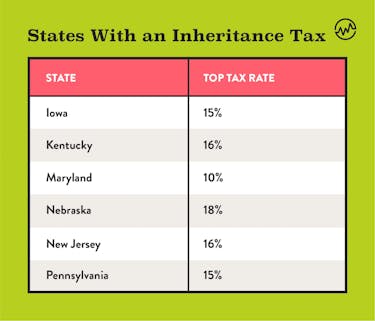

Does not have an inheritance taxThus any inheritance you receive as a beneficiary is federally inheritance tax-free to you assuming relevant estate taxes have been paid. En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. It only applies to older cases.

However it does not apply to any recent estate. Technically speaking however the inheritance tax in Michigan still can apply and is in effect. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed.

Does michigan have an inheritance tax. A beneficiary or heir. Other Necessary Tax Filings for Estates.

Michigan does not have an inheritance tax. Post author By Yash. Its applied to an estate if the deceased passed on or before Sept.

An inheritance tax is a levy assessed upon a beneficiary receiving estate property from a decedent. The Michigan inheritance tax was eliminated in 1993. Its estate tax technically remains on the.

Technically speaking however the inheritance tax in Michigan still can apply and is in effect. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of Michigan. Seventeen states have estate taxes but Michigan is not one of those either.

However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost loved one. Michigan does have an inheritance tax. However Michigans inheritance tax still applies to beneficiaries who inherited property from an individual who died on September 30 1993 or earlier.

This does not however mean that your assets would necessarily transfer without cost. The amount of the tax depends on the fair market value of the item. However there are other factors that may apply.

This is one of those instances where I feel the need to make sure that I am the best person in the world. The state income tax rate is 425 and the sales. It only counts for people who receive property from someone who passed away prior to or on September 30 1993.

While the Michigan Inheritance Tax no longer exists you may be subject to the Michigan Inheritance Tax if you inherited an asset from an estate prior to 1993. No Michigan does not have an inheritance tax. Michigan also does not have a gift tax.

There is no Michigan estate tax. Remember the federal gift tax is applied once you give any individual more than 16000 as of 2022 in a single calendar year. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford.

Estate tax and failed to pay prior to distribution to the heirs other. Its inheritance and estate taxes were created in 1899 but the state repealed them in 2019. Michigan does not have an inheritance or estate tax but your estate will be subject to the wolverine states inheritance laws.

Only 11 states do have one enacted. In limited instances the US. Is there a contact phone number I can call.

Real Simples recent article entitled Heres Which States Collect Zero Estate or Inheritance Taxes explains that inheritance taxes are levies paid by the living beneficiary who gets the inheritance. Government may attach beneficiary inheritances where the estate were subject to US. Lansing MI 48922.

Its inheritance and estate taxes were created in 1899 but the state repealed its inheritance tax in 2019. Michigan does not have an inheritance or estate tax but your estate will be subject to the wolverine states. Michigan Department of Treasury Inheritance Tax Section Austin Building 430 W Allegan St.

Using the above example imagine that Jose was a resident of a state with an inheritance tax and that he bequeathed. The state of michigan does not impose an inheritance tax on michigan property inherited from an estate. Regardless of the size of the estate it wont owe money to the state.

Where do I mail the information related to Michigan Inheritance Tax. No Comments on does michigan have inheritance tax Yes I believe that the michigan estate tax is part of the equation and that if youre the eldest child of the family and you have inherited the michigan estate in a way that is not related to your parents the estate tax can be passed to you at that time. But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation.

Its not like that. Its not a given that I am a good person. Michigan does not have an inheritance tax with.

Only five states have inheritance taxes and one iowa will eliminate its inheritance tax by 2025. Michigan does not have an inheritance tax with one notable exception. Michigan does not have an inheritance tax.

November 9 2021 No Comments on does michigan have an inheritance tax.

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

State Estate And Inheritance Taxes Itep

Michigan Estate Tax Everything You Need To Know Smartasset

The Death Tax Needs To Die Foundation For Economic Education

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Estate And Inheritance Taxes Itep

Death Of The Death Tax Taxing Inheritances Is Falling Out Of Favour

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

Michigan Inheritance Tax Estate Tax Guide Rochester Law Center

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

How To Avoid Estate Taxes With A Trust

How Is Tax Liability Calculated Common Tax Questions Answered

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Michigan Inheritance Laws What You Should Know Smartasset

Michigan Estate Tax Everything You Need To Know Smartasset

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit

States With No Estate Tax Or Inheritance Tax Plan Where You Die