nc sales tax on food items

105-164310 are exempt from the State sales and use tax and. North Carolina Sales of grocery items are exempt from North Carolina state sales tax but still subject to local taxes at a uniform reduced rate of 2.

How To Charge Sales Tax In The Us 2022

In North Carolina grocery items are not subject to the states statewide sales tax but are subject to a uniform 2 local tax.

. Items subject to the general rate are also subject to the. Counties and cities in North Carolina are allowed to charge an additional local sales. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

North Carolina has a 475 statewide sales tax rate but also has 458 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax. North Carolinas general state sales tax rate is 475 percent. The sales tax rate on food is 2.

Sales and Use Tax Sales and Use Tax. Items subject to the general rate are also subject to the. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically.

The North Carolina state legislature levies a 475 percent general sales tax on. 21 rows While the North Carolina sales tax of 475 applies to most transactions there are certain. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69.

Application of Sales and Use Tax to Retail Sales and Purchases of Food Sales and purchases of food as defined in GS. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Candy however is generally taxed at the full.

The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. 105-164310 are exempt from the State sales and use tax and.

How much is tax on restaurant food in North Carolina. Sale and Purchase Exemptions. The information included on this website is to be used only as a guide.

The sales tax rate on food is 2. Counties and cities in North Carolina are allowed to charge an additional local sales. What transactions are generally subject to sales tax in North Carolina.

Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being. What is the sales tax in Charlotte NC.

This page describes the taxability of. Sales and Use Tax Rates. Counties and cities in North Carolina are allowed to charge an additional local sales.

Application of Sales and Use Tax to Retail Sales and Purchases of Food Sales and purchases of food as defined in GS. It is not intended to cover all provisions of the law or every taxpayers. Certain items have a 7-percent combined general rate and some items have a miscellaneous rate.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. How much is restaurant tax in NC.

Understanding California S Sales Tax

Flush States May Exempt Food From Sales Tax

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

Is Food Taxable In North Carolina Taxjar

20 Food And Stockpiling Pdf Downloads Emergency Food Storage Emergency Food Supply Emergency Food

Holy Meaningful Receipt Roland Ginger Ale Mozzarella Sticks Receipt

Stunt Foods Food Articles Food Innovation Fast Food Items

How To Register For A Sales Tax Permit Taxjar

How To Charge Your Customers The Correct Sales Tax Rates

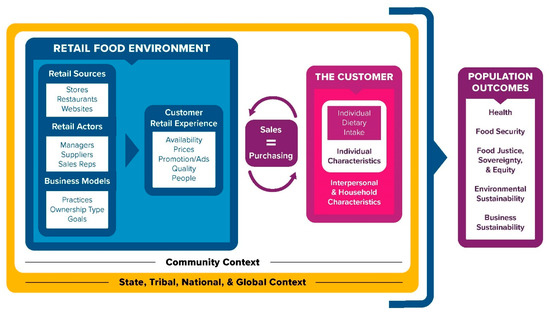

Ijerph Free Full Text A Model Depicting The Retail Food Environment And Customer Interactions Components Outcomes And Future Directions Html

Taxes On Food And Groceries Community Tax

Flush States May Exempt Food From Sales Tax

Sales Tax On Grocery Items Taxjar

Epcot Festival Of The Arts Information Epcot Festival Food Network Recipes

Is Food Taxable In North Carolina Taxjar

Epcot International Flower Garden Festival Information Epcot Flower Garden Festival