what is suta tax california

2021 SUI tax rates and taxable wage base. Who pays Suta in California.

California S Unemployment Crisis Explained Calmatters

PIT is a tax on the income of California residents and on income that nonresidents get within California.

. State unemployment tax is a percentage of an employees. According to the EDD the 2021 California employer SUI tax rates continue to. The SUI taxable wage base for 2021 remains at 7000 per employee.

SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages. Keep in mind that earnings exceeding 7000 are not taxed and it is the employer who pays this tax and not. We work with the California Franchise Tax Board FTB to administer this program.

The states SUTA wage base is 7000 per. SUTA or the The State Unemployment Tax Act SUTA is a payroll tax paid by all employers at the state level. Register immediately after employing a worker.

1 day agoA Valero gas station in Sacramento on March 10 2022. Every state may also determine its own SUTA taxable wage base ie how much of an employees wages are taxed for SUTA. Photo by Miguel Gutierrez Jr CalMatters.

The new-employer tax rate will also remain stable at 340. See Determining Unemployment Tax Coverage. Timeline for receiving unemployment tax number.

FUTA tax rate is 6 of the first 7000 paid to an employee annually. Essentially FUTA is a payroll tax paid by employers on employee wages. California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage.

The amount of the tax is based on the employees wages and the states unemployment rate. SUTA dumping is a tax evasion scheme where shell. Employer registration requirement s.

California was one of the first states to enact legislation as a. You might be interested. State Unemployment Tax Act SUTA dumping is one of the biggest issues facing the Unemployment Insurance UI program.

In California for example quarterly returns for SUTA and other state payroll taxes are due on April 30th July 31st October 31st and January 31st. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Newsom took his fight against oil and gas companies up a notch on Tuesday.

The Federal Unemployment Tax Act FUTA is similar to SUTA in that its a tax paid by employers. Employers with a positive reserve balance or those with a new employer tax rate will also be subject to the. The state typically issues a SUTA tax.

Example In Oklahoma for example the SUTA tax rate is 27. SUI tax aka SUTA tax and FUTA tax are both unemployment-related payroll taxes.

Appealing A Denial Of Unemployment Benefits After A Wrongful Termination In California Odell Law Top Employment Lawyer In Los Angeles Orange County

Explained How To Report Unemployment On Taxes Youtube

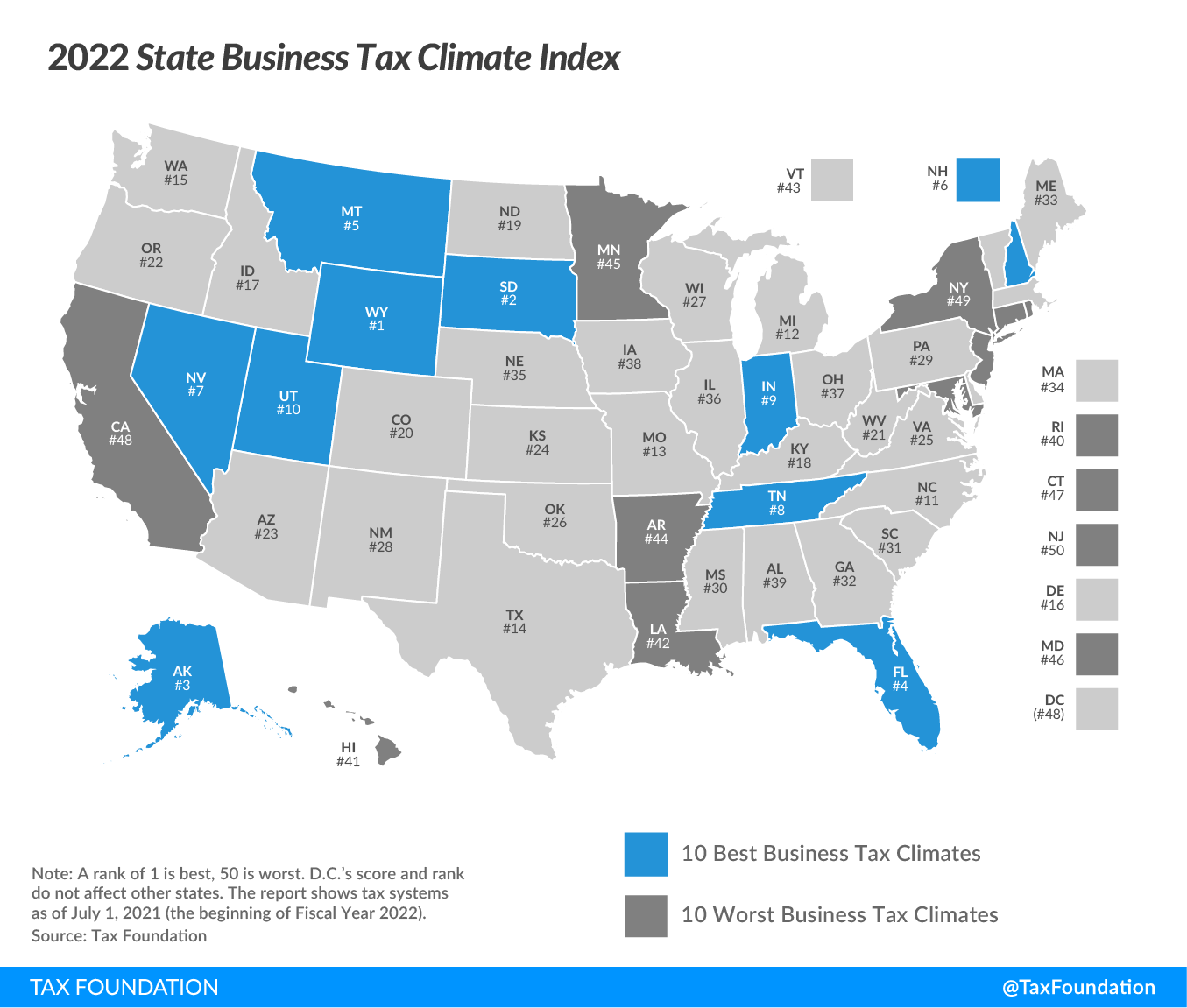

2022 State Business Tax Climate Index Tax Foundation

How Much Does An Employee Cost In California Gusto

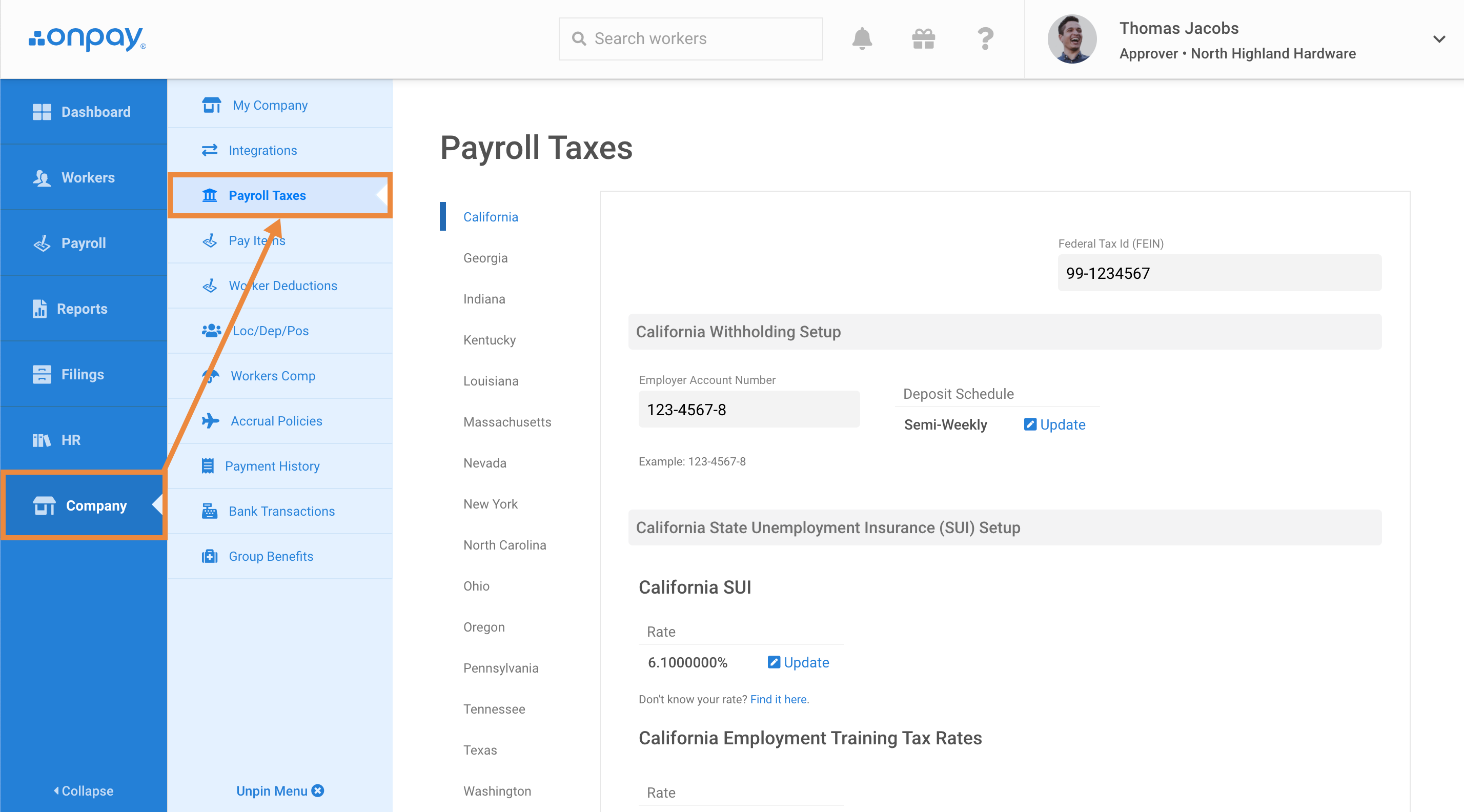

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

2022 Federal State Payroll Tax Rates For Employers

Suta Tax Requirements For Employers State By State Guide

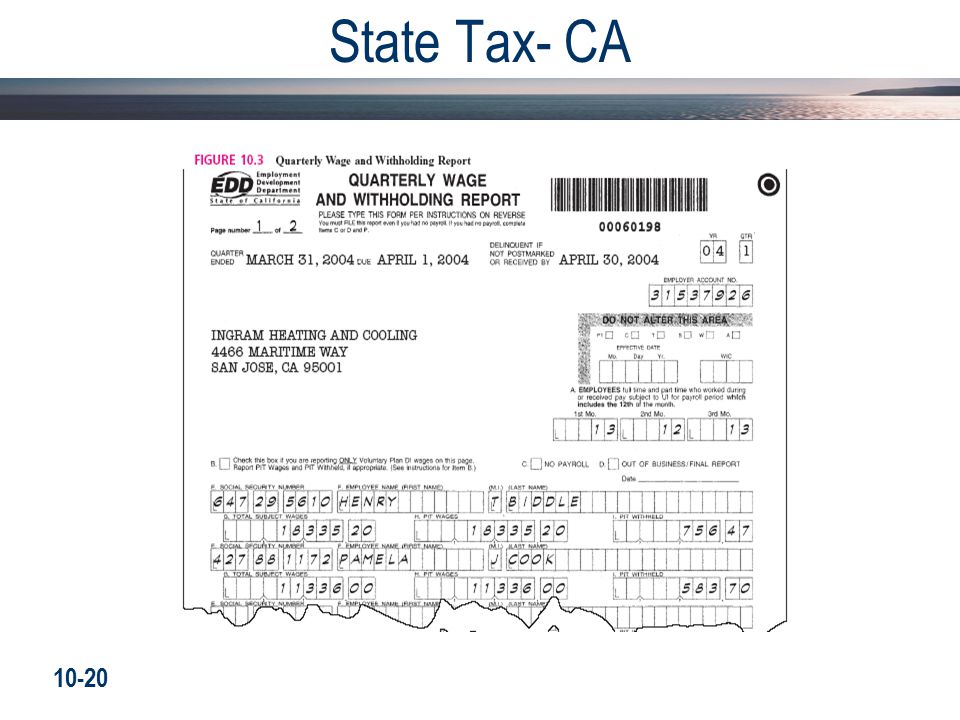

10 1 Unit 10 State Payroll Taxes And Reports Mcgraw Hill Irwin Copyright C 2006 The Mcgraw Hill Companies Inc All Rights Reserved Ppt Download

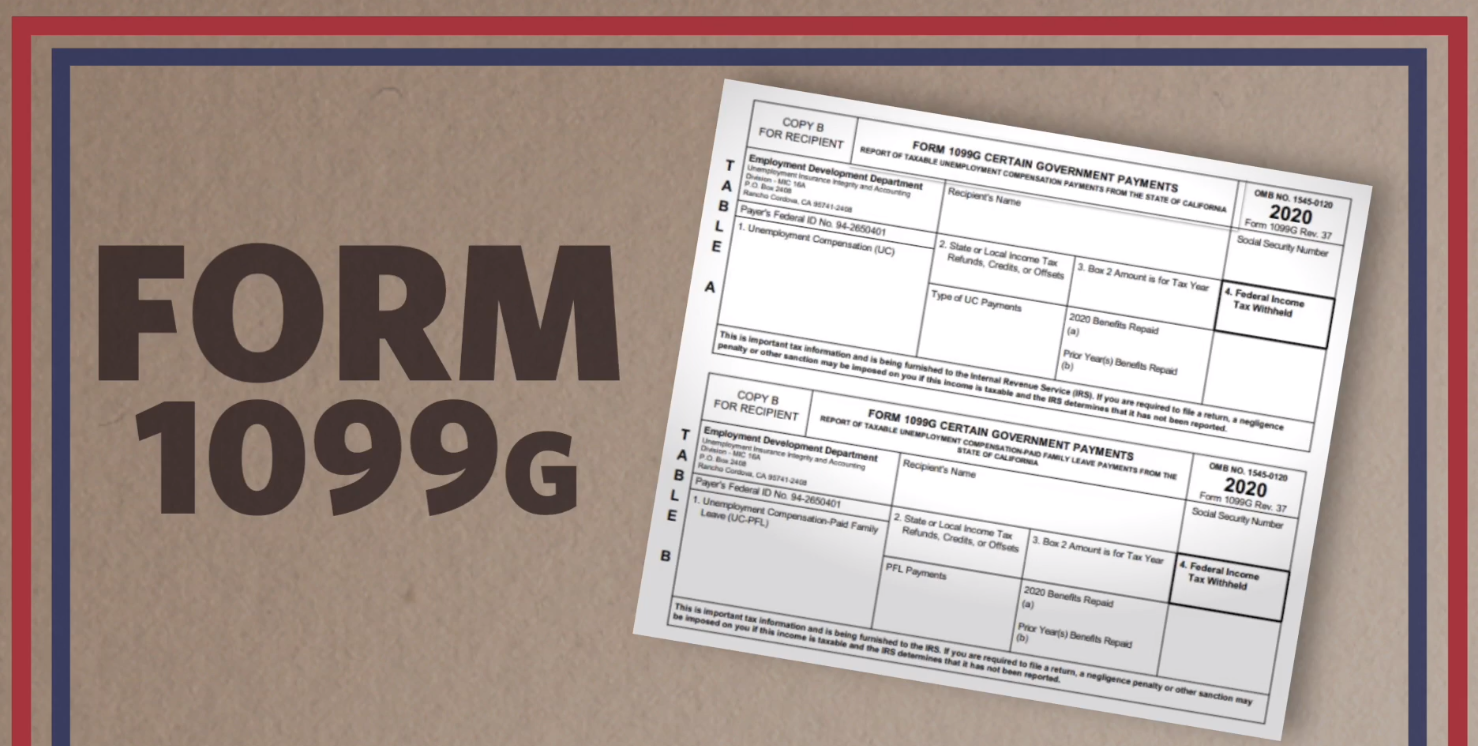

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Understanding California Payroll Tax

Explained How To Report Unemployment On Taxes Nbc Bay Area

Suta Tax Your Questions Answered Bench Accounting

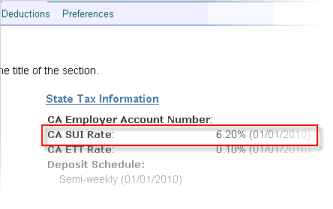

How To Update Your Sui Tax Rates And Deposit Schedule Help Center Home

Is California Blowing It On Unemployment Reform News Almanac Online

Did You Collect Unemployment Benefits In 2020 Act Now To Avoid A Tax Day Surprise Dollars And Sense Abc10 Com