can i withdraw from my 457 without penalty

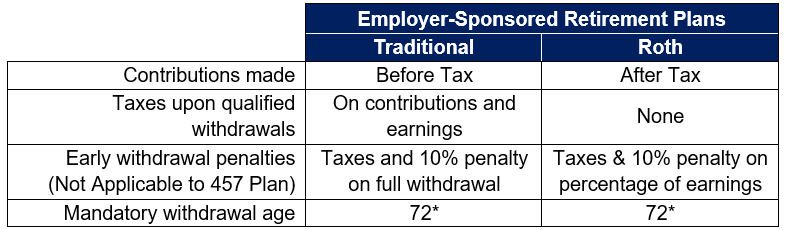

The 403b and 457b plans are both tax-deferred retirement savings accounts that cover nonprofit entities like governments churches and charities. Your previous employer can release your 401k in two ways.

Are You Thinking Of Accessing Your Retirement Funds Due To Covid 19

Yes 457 plans are great if you can get them but you need to work for a governmental entity.

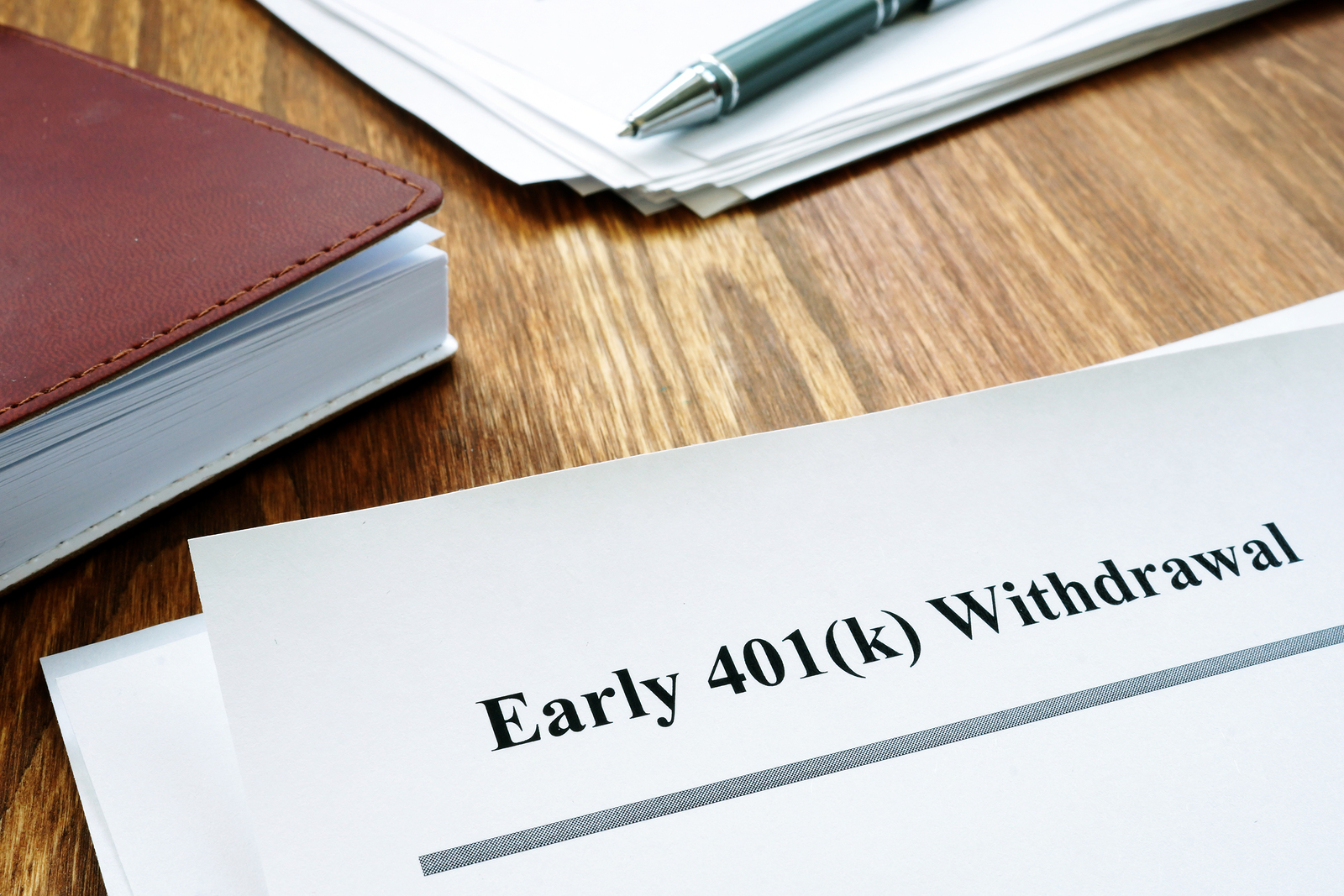

. You can contribute to either plan or both plans depending on your budget. You can withdraw Roth individual retirement account IRA contributions at any time for any reason without paying taxes or penalties. 457b plans are not subject to the Age 59 12 rule meaning you can access the money without penalty as soon as you leave the employer.

They differ in that 403b withdrawal rules are more like 401k withdrawals. I work for the State so I fund both a 401k and a 457. Having your 401k funds rolled over to another retirement account is a great option.

Not sure its fair to the rest of you that arent government employees. As a UC employee you can contribute to the 403b and the 457b as long as you are not a student working fewer than 20 hours per week. This post will go through how much I think you should have in your 401k by age in order to have a comfortable retirement in your 60s and beyond.

When you reach 59 12 you can generally withdraw funds from your 401k to. Rolling Over Your 401k From a Previous Employer. Named after Internal Revenue Code Section 457b a.

Great deal for us government employees. Rolling over old 401ks to a new retirement account ensures youll continue growing your retirement fund and youll avoid being penalized for an early withdrawal. The maximum amount you can contribute is 20500 for 2022 up from 19500 in 2021.

Without a penalty from my Deferred Compensation Plan account. The 401k is one of the most woefully light retirement instruments ever invented. Withdrawals from a 457b plan are highly regulated so you may not be able to access.

Employees of governments and some nonprofit organizations can save for retirement with 457 plans. If you are a participant in the pre-tax 457 Plan you may begin distribution without a penalty upon age 59½ or upon severance from City employment regardless of your age. The minimum retirement age for most 401k withdrawals to avoid early withdrawal tax penalties is 59 12.

In 2022 you can contribute up to 20500 to each plan if you are under age 50 up to 41000 total this year. Are you looking for a 401k savings guide. Youll pay a penalty tax if you withdraw funds before reaching age.

If I ever leave state employment I can access the 457 funds penalty free. As with a 401k plan you can get a tax deduction on money you contribute to a 457b plan and your earnings grow on a tax-deferred basis. A 457b plan is a tax-advantaged retirement plan restricted to state and local public governments and qualifying tax-exempt institutions.

2 No Early Withdrawal Penalty. You can contribute up. Certain employers may offer both types of plans.

If you do not take your RMDs when required you will have to pay a 50 penalty on the money you were required to withdraw from your account. Theyre a great option to spend during early retirement. Regarding distributions from the Roth 457 these can be taken income tax-free provided you are age 59½ or.

You just withdraw from the 457b first and leave your other retirement accounts until your 60s and later.

403 B Vs 457 B What S The Difference Smartasset

Everything You Need To Know About 457 Plans Deferred Compensation

Everything You Need To Know About 457 Plans Deferred Compensation

How A 457 Plan Works After Retirement

457 B Vs 401 K Plans What S The Difference Smartasset

Can I Max Out My 401k And 457 Here S How It Works

Everything You Need To Know About 457 Plans Deferred Compensation

How 403 B And 457 Plans Work Together David Waldrop Cfp

Irc 457 Early Withdrawal Guidelines

Everything You Need To Know About A 457 Real World Made Easy

457 Retirement Plans Their One Big Advantage Over Iras Money

Irc 457 Early Withdrawal Guidelines

Irc 457 Early Withdrawal Guidelines

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

Should You Take An In Service Non Hardship Withdrawal From Your Workplace Retirement Plan Frontier Wealth Management